Temple Voters: Don’t be “October Surprised”

October surprises are usually political tricks aimed at candidates, but with the upcoming election, many city of Temple voters will receive one in the form of an unexpected special election on their ballots.

October surprises are usually political tricks aimed at candidates, but with the upcoming election, many city of Temple voters will receive one in the form of an unexpected special election on their ballots.

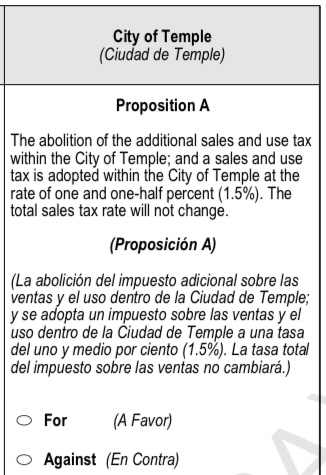

While the Nov. 7 election ballot will include 14 constitutional amendments, a lesser-known measure will also ask voters to approve a change to Temple’s current sales and use tax structure.

How would one know about this special election?

Simple answer. Not likely you would.

Aside from finding it on a Temple-configured Bell County sample ballot, we’ve been unable to find any media or other outside discussion on it.

Election information is on the city website, but accessible only upon navigating through several pages. The most direct route appears that from the home page, use the drop-down menu bar at the top of the page to click Departments. From there, click Elections and under “Related Pages” click Election November 2023.

What’s being voted on?

2023 Bell County Uniform Election Sample Ballot (Temple version)

While this seems a technicality of little consequence, that such an action requires voter approval prompts curiosity if perhaps more is at play.

How sales and use taxes work

Per the State Comptroller’s office:

Texas imposes a 6.25% state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Local taxing jurisdictions (cities, counties, special purpose districts and transit authorities) can also impose up to 2 percent sales and use tax for a maximum combined rate of 8.25%.

Temple residents pay 0.5% sales tax to Bell County and 1.5% (1% general and 0.5% additional sales tax) to the city of Temple for a state and local tax rate of 8.25%.

With regard to Proposition A, the city of Temple website offers the following:

What does my vote mean?

A vote FOR Proposition A: maintains 1.5% total sales tax rate; dedicates all local sales tax revenue to general government purposes; preserves current revenue levels.

A vote AGAINST Proposition A: maintains 1.5% total sales tax rate; makes no change to the 0.5% additional sales tax classification; may cause revenue loss from future legislative changes to tax rate calculations.

Will my tax rate change?

No. A vote FOR or AGAINST Proposition A will not change your current municipal sales tax rate of 1.5% or your current property tax rate of 61.30 cents per $100 valuation.

How is local sales tax used?

Local sales tax is used for general government purposes. Proceeds are placed in the General Fund and pay for services that include police, fire, parks, libraries, animal services and certain infrastructure improvements. The additional sales tax is currently used in this manner and will continue to be used for these purposes.

How is sales tax applied?

Sales tax is applied to the purchase of most goods and services in Texas at a maximum rate of 8.25%. The current and proposed distribution of revenue from sales tax is as follows:

Why has a special election been called?

In 1990, Temple voters adopted an additional sales tax, creating a revenue source that is paid by residents and non-residents and used for essential city services, including public safety and quality of life. The additional sales tax is used in the calculation of the property tax voter approval rate, which was lowered by state statute in 2020. Voters are being asked to consider changing the additional sales tax use to general government purposes to simplify this process.

Additional analysis

The State Comptroller’s Office describes the Additional Sales Tax Rate:

Cities, counties and hospital districts may levy a sales tax specifically to reduce property taxes.67In which case, the taxing unit reduces its no-new-revenue and voter-approval tax rates to offset the expected sales tax revenue.68

Based on the city’s position, moving the 0.5% sales tax stream from additional to the general is revenue neutral because the two taxes are already currently combined “and will continue to be used for these purposes.” The purposes include “police, fire, parks, libraries, animal services and certain infrastructure improvements.”

However, the State Comptroller’s language specifies that under the current structure, keeping the additional sales tax separate allows these funds to be used as a property tax offset.

While the property tax offset triggered by the additional sales tax, as outlined by the comptroller, may be viewed as complicating calculations, it also seemingly provides taxpayer benefit.

Applying the Comptroller’s language and using numbers from the October sales tax reports as published in the Temple Daily Telegram, 2023 property taxes are currently being reduced by $10,125,277.10 year to date – $30,375,831.30 total sales tax year to date for Temple divided by 3 (the 0.5% additional sales tax rate of the 1.5% total or 1/3 of the sales tax goes to offset the property tax).

Temple Daily Telegram Screenshot

A vote for the proposition appears to stop the property tax offset thus allowing the city, if desired though unlikely, to increase property taxes by at least the $10,000,000 for 2023 or to increase them in the future. As the additional sales tax numbers cause the city to reduce its no-new-revenue rate, the voter-approved tax rate is also reduced. By moving the 0.5% away from property tax reduction, the no-new-revenue rate and the voter-approved rate are automatically higher allowing for future city taxation without voter approval.

Consider also that sales taxes are consumption taxes. They are paid not only by local residents, but also by visitors or others from outside the city of Temple. With the current structure, Temple property taxpayers receive additional benefit as a portion of property tax dollars are paid – via the additional sales tax – by non-residents.

When the average Temple resident in concert with Americans across this country are faced with rising living costs and seek ways to reduce their own financial liabilities, it’s not unreasonable that government entities should be committed to doing the same. With that, keeping these two funds separate seems to allow flexibility in offsetting future property tax increases.

Flexibility or simplicity? While, per the city, approving the proposition will purportedly simplify the process of calculating the property tax voter-approved rate, might taxpayers be better served by flexibility that helps avoid tax increases? And since when are government entities champions of streamlined processes?

What advice are cities receiving on sales tax special elections?

It was interesting to come across this directive on the Texas Municipal League website. With regard to sales and use tax elections, General Counsel Bill Longley wrote:

Q Our city is “maxed out” at the two-percent sales tax cap. May we hold an election to switch from one city sales tax to another?

A Yes. A city may hold an election to repeal or lower one city sales tax, and raise or adopt a different sales tax, all with one combined ballot proposition. See TEX. TAX CODE § 321.409. The fact that this may be accomplished by one combined ballot proposition protects the city’s interest by eliminating the risk that one tax will be voted out by the citizens without the other tax being voted in. A combined ballot proposition must be worded to contain substantially the same language required by law for each of the two taxes individually. See id. § 321.409(b).

Note that prior to 2017, the law only authorized a city to use a combined ballot proposition when switching from one dedicated city sales tax to another dedicated city sales tax. In 2017, H.B. 3046 passed, which expanded the applicability of the combined ballot proposition statute to all city sales taxes, including the general revenue sales tax. See id. § 321.409(a).

(Emphasis added)

Sadly, this is how government works. TML is an organization that supports Texas cities. Taxpayer dollars are used to fund membership in this organization that advocates for endless expansion in the size and scope of government via its organizational guidance and lobbying efforts.

This lobbying organization – financed by taxpayer funds – has been at the forefront fighting against taxpayer-funded lobbying bans. Per Texas Public Policy Foundation:

And yet, that philosophical framework is under threat today from a practice promulgated by Texas’ local governments. This pernicious practice sees local officials spend tax dollars to hire registered lobbyists to petition state lawmakers for more spending and higher taxes. In other words, local governments are spending taxpayer money to lobby for more government. And it’s no small sum either.

According to a new report, local governments spent as much as $75 million in 2021 to lobby the legislature against taxpayer interests. Worse, that figure only tells part of the story as it “excludes the salaries and activities of in-house lobbyists, also known as intergovernmental relations personnel, as well as membership dues and other monies paid to pro-government associations, like the Texas Municipal League, the Texas Association of School Boards, and others.” In all, local governments spent an appalling amount attempting to influence legislation.

TML was likely a strong supporter of HB 3046 which as, per Longley, “protects the city’s interest.” In a time when people want low taxes and small government, who’s protecting taxpayer interests?

Bottom line

The city’s arguments of voting FOR this proposition is that it maintains a 1.5% total sales tax rate and protects current general government fund revenue levels.

Voting AGAINST this proposition, per the city of Temple, “may cause revenue loss from future legislative changes to tax rate calculations.”

It may, but then again, it may not. But if we want to talk about what may happen in the future, remember the example cited above.

Voting AGAINST this proposition also keeps the property tax offset dollars (as generated through the additional sales tax rate) that can help avoid future tax increases without voter approval.

Today’s taxpayers are sensitive to increased financial burdens and with that, governments approving mechanisms that seemingly open the door to increased property taxes are an ill-timed effort.

And one last thought. If this measure is important enough to merit a special election, why isn’t it getting more attention? Low turnout elections coupled with minimal voter knowledge and/or participation can bring unexpected results. Beware the October surprise.

Lou Ann Anderson is a writer, former radio producer and current podcaster at Political Pursuits. Her tenure as Watchdog Wire–Texas editor involved covering state news and coordinating the site’s citizen journalist network. As a past Policy Analyst with Americans for Prosperity–Texas, Lou Ann wrote and spoke on a variety of issues including the growing issue of probate abuse in which wills, trusts, guardianships and powers of attorney are used to loot assets from intended heirs or beneficiaries. She holds a degree from the University of North Texas in Denton.