Temple’s Prop A Ballot Measure Offers an Expensive Proposition

Bell County TX Screenshot

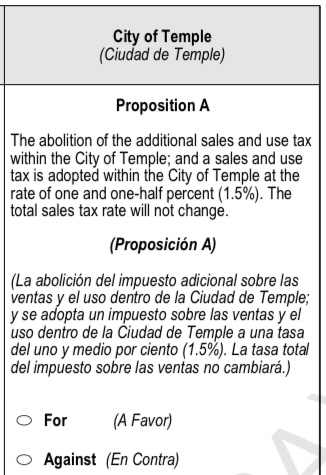

Temple voters will soon vote on Proposition A, a measure to abolish the city’s additional sales and use tax, a mechanism currently beneficial to residents as an offset to their property taxes. As proposed, abolition of this tax will trigger a mechanism for imposing significant tax increases.

Termed an “October surprise” in a prior article, Temple voters will find this proposition at the end of their ballot following the 14 well-publicized constitutional amendments.

2023 Bell County Uniform Election Sample Ballot (Temple version)

Getting down to basics

While not an issue easily explained, voting FOR this proposition will enable the city of Temple to alter its tax rate calculations and increase the average residents’ property tax liability.

Want higher taxes? Vote FOR Proposition A.

At a very basic level, consider this.

The city needs a pool of money to use for its budget. That includes money for providing services, maintaining infrastructure, offering programs, etc. Such money is generally accumulated through taxing the people – i.e., property taxes.

Currently however, Temple operates with an “additional sales and use tax” provision of 0.5% (one-third of the 1.5% total city sales tax) that was voter-approved and allows this portion of sales taxes to be deposited into that city money pool. These funds, also known as an “offset,” mean taxpayers contribute less to the bigger pool. Stated differently, property owners enjoy reduced taxes.

Abolishing this tax classification as the city wants will stop the “additional” sales tax portion of money going into the larger pool and therefore require more of the people’s dollars.

This system may seem ridiculously complicated, but as with much of government, that’s likely by design.

Real numbers make the point

Using numbers from the October sales tax reports as published in the Temple Daily Telegram, 2023 property taxes are currently being reduced by $10,125,277.10 year to date – $30,375,831.30 total sales tax year to date for Temple divided by 3 (the 0.5% additional sales tax rate of the 1.5% total or 1/3 of the sales tax goes to offset the property tax).

Temple Daily Telegram Screenshot

A vote for the proposition appears to stop the property tax offset thus allowing the city, if desired though unlikely, to increase property taxes by at least the $10,000,000 for 2023 or to increase them in the future. As the additional sales tax numbers cause the city to reduce its no-new-revenue rate, the voter-approved tax rate is also reduced. By moving the 0.5% away from property tax reduction, the no-new-revenue rate and the voter-approved rate are automatically higher allowing for future city taxation without voter approval.

Again, it’s complicated.

And consider also that sales taxes are consumption taxes. They are paid not only by residents, but also by others from outside the city of Temple be it local company non-resident employees or visitors. With the current structure, Temple property taxpayers receive additional benefit as a portion of property tax dollars are paid – via the additional sales tax – by non-residents.

A vote FOR Proposition A removes this benefit.

The city’s own numbers

A look at the city’s 2023 Tax Rate Calculation Worksheet illustrates the current impact of the additional sales and tax rate and offers insight to the consequences of abolishing the tax.

Note the Section 3 header:

Cities, counties and hospital districts may levy a sales tax specifically to reduce property taxes. Local voters by election must approve imposing or abolishing the additional sales tax. If approved, the taxing unit must reduce its NNR and voter-approval tax rates to offset the expected sales tax revenue.

NNR stands for no-new-revenue tax rate.

With Temple’s measure, the city is seeking to abolish a sales tax specifically implemented to reduce property taxes. If Proposition A is approved, the taxing unit must increase its NNR and voter-approval tax rates to offset the expected sales tax revenue decrease.

Line 54 of the sheet above lists the 2023 sales tax adjustment rate as 0.1569. This is the amount of tax offset generated by the current additional sales and use tax. Line 57 shows a voter-approved tax rate of 0.7841, a calculation prior to factoring in the offset (Line 54). With that, Line 58 reflects the adjusted voter-approved tax rate. After the sales and use tax dollars (Line 54) are deducted from the voter-approved rate (Line 57), the adjusted rate is reduced to 0.6272.

Temple’s 2023 tax rate of 0.6130, the same as it was for 2022, includes the sales tax adjustment. The 2023 rate could have gone up to 0.6272.

Under the current rate, a $200,000 house would currently be assessed $1,226 in city taxes. Without the adjustment, that same house could be taxed as high as $1,568 to compensate for the “lost” additional sales and use tax dollars. And this is not factoring in potential appraisal increases.

Additional perspective

Scot Arey of the Central Texans for Property Tax Reform FB group posted this response upon reading our Temple Voters: Don’t Be “October Surprised” column.

“It’s a huge windfall to the city of Temple and its passage only needs voter approval or a lack of voter education,” Arey said. “Abolishing the additional sales and use tax removes a constraint on how they set taxes and provides a higher base line for future taxes.”

Arey’s point about voter education is especially on target as this ballot measure has received virtually no public attention – even from the government that called this special election.

Early voting starts Monday

Election Day is Tuesday, Nov. 7, but early voting starts Monday, Oct. 23. Click here for voting information.

One continues to wonder why if this measure is important enough to merit a special election, why it also isn’t getting more attention? But then again, maybe the answer is the obvious.

Several pages into its website, the city positions this tax abolition as a technicality, an administrative simplification that won’t change your sales tax rate. Sounds innocuous. Research suggests a different scenario of which few Temple voters are likely aware.

Low turnout elections with minimal voter knowledge are a recipe unexpected results and consequences. So once again, beware the October surprise.

Lou Ann Anderson is a writer, former radio producer and current podcaster at Political Pursuits. Her tenure as Watchdog Wire–Texas editor involved covering state news and coordinating the site’s citizen journalist network. As a past Policy Analyst with Americans for Prosperity–Texas, Lou Ann wrote and spoke on a variety of issues including the growing issue of probate abuse in which wills, trusts, guardianships and powers of attorney are used to loot assets from intended heirs or beneficiaries. She holds a degree from the University of North Texas in Denton.